Tax teams operate faster with AI.TaxAssist, empowering you to scale quickly. Generate tax computations in minutes using interactive dashboards with auto tax classifications, editable rules, adjustments, schedules, and more at your fingertips.

Don’t just take our word for it.

Tax Advisory & Compliance

InCorp Global

“AI.TaxAssist took over the heavy lifting and the field work from my team. We can now rely on the AI to comb through GL, ensuring higher accuracy of the tax computation, yet saving us a huge amount of time in tax computation preparation.”

“Compared to traditional tax software which are actually tax calculators, AI.TaxAssist frees us from the tedious work—so we can focus on delivering expert tax advice faster and more accurately.”

“Unlike their competitors, AI.TaxAssist is so much more. They ensure filing convenience as well as accuracy. The whole filing process has become more of a breeze than a chore!”

See why tax firms are switching to AI.TaxAssist

All-in-one workflow management, interactive client portal, and advanced automation

Everything your tax team needs to operate faster.

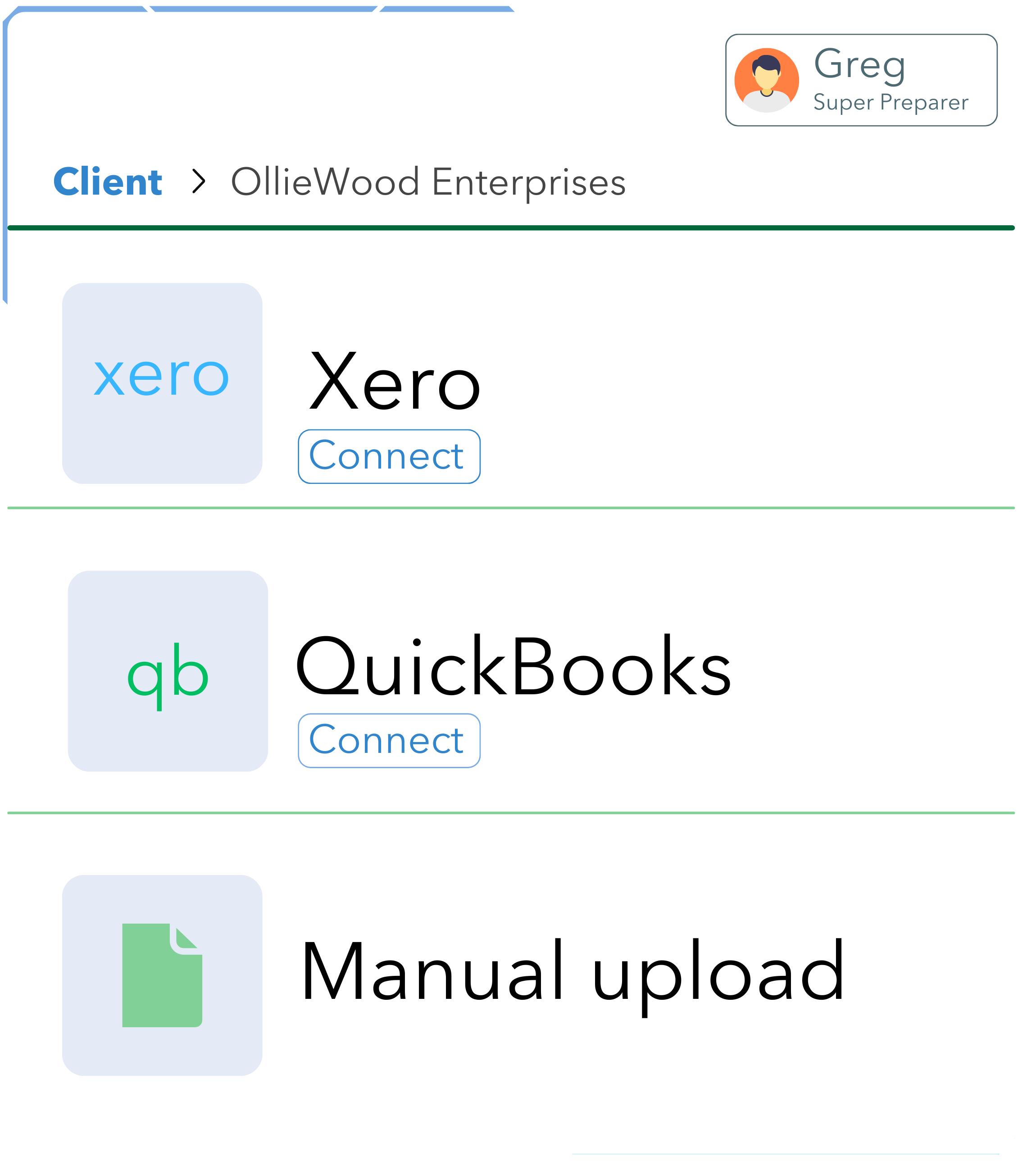

Data that flows, not fights

Connect to Xero or QuickBooks and watch the magic happen. Every transaction, every detail gets pulled and organised instantly. No spreadsheets, no manual entry—just pure efficiency.

Predictive tax classifications

We know taxes are tedious. The power of AI.TaxAssist means automatic coding and labelling of GL items with assigned tax statuses in real-time. Our system supports validations between PL and GL, automatically flagging mismatches.

Near-instant tax computations

Generate tax computations for Form C/C-S in minutes, not hours. AI.TaxAssist produces clean, accurate statements — just review, approve and submit directly to IRAS.

Super accessible pricing

Powerful tax software that grows with your practice. Whether you serve 50 clients or 2,000, AI.TaxAssist makes enterprise-grade tax automation accessible to firms of every size. Eliminate the busywork, boost your efficiency, and watch your practice grow. No steep learning curve, no complex pricing—just the tools you need to succeed.

Tax software that does more

Whether you are building your practice or cutting costs, AI.TaxAssist works for you.

Client portal

AI.TaxAssist brings all your clients into a single, streamlined system. Collaborate efficiently with secure document vaults, messaging, and action items.

Excel Compatibility

Experience real efficiency from the start. AI.TaxAssist solves the problem of handling multiple data formats by ingesting financials in any Excel format.

Customisable Rules

Set rules to save hours of work — e.g., mark “corporate tax” as a “non-tax deductible expense,” and AI.TaxAssist will automatically apply it.

See AI.TaxAssist in action

AI.TaxAssist connects all your systems to one source of truth for clients’ financial data, so you can manage, automate, prepare and submit all filings on one powerful platform.

Elevate your tax practice

Get started with AI.TaxAssist

Frequently Asked Questions

AI.TaxAssist is an AI-driven tax software that automates and streamlines tax tasks, enhancing efficiency, reducing errors, and saving time for your team to focus on higher-value work.

AI.TaxAssist stands out by integrating advanced Artificial Intelligence (AI) and machine learning across all facets of the platform, automating tax computations and predicting tax classifications for unparalleled accuracy and efficiency.

Seamlessly integrate data from Xero and QuickBooks with one-click imports, eliminating manual entry. Benefit from comprehensive workflow management with customisable rules and approval levels.

Our client portal enhances communication with secure document vaults, messaging, and action items. Plus, AI.TaxAssist offers one-click filing to IRAS for Form C-S, simplifying compliance.

AI.TaxAssist integrates smoothly with popular accounting software like Xero, QuickBooks, allowing for easy data import without manual entry.

Yes, AI.TaxAssist will soon include support for multi-country filings, making it ideal for practices with international clients.

AI.TaxAssist ensures data protection with advanced security measures such as encryption, secure document storage, and regular security audits.

AI.TaxAssist can generate precise tax computations for Form C/C-S in minutes, with the ability to directly submit Form C-S to IRAS with one click.

Yes, AI.TaxAssist comes with built-in tax rules and calculations, including restrictions on medical expenses, capital allowances, and more.

Yes, AI.TaxAssist features standardised tax computation templates aligned with the Singapore Income Tax Act, simplifying and streamlining the review process.

Yes, AI.TaxAssist can perform tax computations in non-SGD functional currencies, ensuring accurate and compliant calculations for international clients

Yes, AI.TaxAssist can create detailed fixed asset schedules, including additions, hire purchase capital allowances, disposals, and more.

Yes, AI.TaxAssist automatically creates relevant schedules and cross-references them, updating as needed to ensure accuracy and efficiency.

Yes, AI.TaxAssist performs automatic adjustments based on the levels and rules specified in the Singapore Income Tax Act, such as the order of set-off for capital allowances and donations against income.

Yes, AI.TaxAssist allows you to carry forward data to the next Year of Assessment with just one click.